Difference Between Takaful and Conventional Insurance

In place of interest a profit rate is defined in the contract. The difference between Takaful and Conventional life insurance.

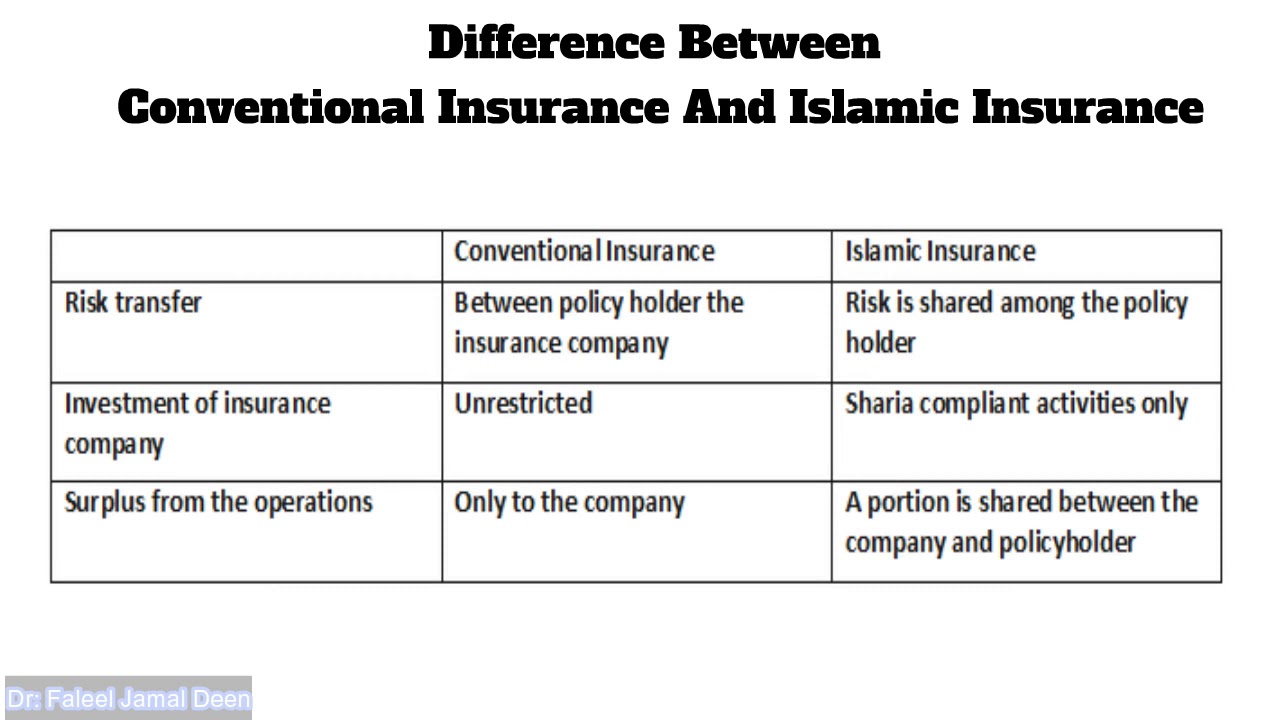

Table 1 From Demographic Analysis Towards The Understanding Of Education Takaful Islamic Insurance Plan Semantic Scholar

Your M2U Account Summary shows your real time account balances and transactions to date.

. In takaful participants agree to offer mutual assistance taawun and protection to each other by contributing funds Tabarru into a pool system. The key difference between Takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the Takaful fund is managed. Takaful is based on Shariah Laws whereas conventional insurance complies with Government laws only.

Based on commercial factors only. Glossary Islamic Banking Islamic vs Conventional Banking. Similar to applying for a conventional personal loan the requirements of applicants are the same.

A fixed deposit or FD is a type of bank account that promises the investor a fixed rate of interestIn return the investor agrees not to withdraw or access their funds for a fixed period of time. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. The major difference between Islamic personal loans and conventional personal loans is the way banks make their profit.

This module aims to provide an understanding of the takaful concept business models and products. All eligible ASB investors under ASNB guidelines who are between the ages of 18 and 60 years old. The words aval and Cavallo were themselves derived.

Rather than paying premiums to a company the insured contribute to a pooled fund overseen by a manager and they receive any profits from the fund. What is the difference between Conventional Auto Loan and Islamic Auto Finance. Allied Bank Roshan Digital Account is aimed to provide digital banking solutions to millions of Non-Resident Pakistanis NRPs and POC holders.

For Non Malaysian with Resident Gross Income of RM15000 and above. Additional 5 for 100 MoF is including insurance. There is a wide difference between the lowest and highest interest rates offered in Malaysia.

Now NRPs and POC holders willing to undertake banking payments and investment activities can do so through digital channels without visiting bank branches in Pakistan. Individual with income documentation only. Although essentially both Takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below.

What is the difference between takaful and insurance. Takaful sometimes called Islamic insurance differs from conventional insurance in that it is based on mutuality so that the risk is borne by all the insured rather than by the insurance company. Insurance is a means of protection from financial loss.

In a fixed deposit interest is only paid at the very end of the investment period. What is the difference between my M2U Account Summary and Bills Statements. Islamic Financing Conventional Financing.

التكافل sometimes translated as solidarity or mutual guarantee is a co-operative system of reimbursement or repayment in case of loss organized as an Islamic or sharia compliant alternative to conventional insurance which contains riba usury and gharar excessive uncertainty. For more information about the difference between these loans. Insurer and the participants under conventional it is the.

Is a financial contract between two or many parties to establish a commercial enterprise based on capital and labor. Hence on face value Islamic banks may look similar to conventional banks but the contracts and product structures used by Islamic banks are different from conventional banks. With Takaful or Insurance vs Without Takaful or Insurance.

With Takaful or Insurance coverage. Joint venture Musharakah. The fixed deposit with the highest interest we could find was the Affin Bank Term Deposit-i at a rate of 4 while the lowest interest rate was.

Under takaful people and companies concerned about hazards make. The Hawala an early informal value transfer system has its origins in classical Islamic law and is mentioned in texts of Islamic jurisprudence as early as the 8th century. Student is not eligible to apply except working students with fixed income.

Candidates will be exposed to the concept of risk and mitigating such risks through takaful and candidates will learn the legal and Shariah regulations governing the takaful industry. Before moving further is there a difference between Commodity Murabaha and Tawarruq. Further differences are also present in the relationship between the operator under conventional insurance using the term.

An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity. Profit and loss sharing. MBSB Conventional Fixed Deposit.

Bills Statements stores your monthly account credit card trading account and other statements. Islamic financing plan with low monthly payments and optional Takaful coverage. Hawala itself later influenced the development of the agency in common law and in civil laws such as the aval in French law and the Cavallo in Italian law.

Is a contract between two parties. Auto Finance is a Shariah Compliant contract based product where the bank sells an asset at a profit as Islamic Banks are prohibited from charging interest. Without Takaful or Insurance coverage.

Liability coverage that helps settle all unpaid balances in the event of death or total permanent disability of the borrower. Comparison of Islamic. One provides the capital and the other provides the labor to form a partnership to share the profits by certain agreed proportions.

Based on mutual cooperation. Compare profit rates and apply online now. What are the differences between Islamic loan and Conventional loan.

Not many scholars made this distinction between these two terms but in the early days Bai Inah was a transaction done by 2-parties and Commodity Murabaha transactions was either a transaction among 3-parties Bank-Customer-Broker or 4-parties Bank-Customer-Broker A-Broker B. Legal instrument deed cheque is the Arabic name for financial certificates also commonly referred to as sharia compliant bondsSukuk are defined by the AAOIFI Accounting and Auditing Organization for Islamic Financial Institutions as securities of equal denomination representing individual. Written by iMoney Editorial.

Malaysias takaful assets reached 91 billion US dollars as of December 2019 with the share of takaful net contributions as a proportion of the. Furthermore in the verse 2275 of the Holy Quran Allah has responded to the apparent similarity between trade and interest by saying that He has permitted trade and. Allied Aitebar Khanum Services.

What is the validity of an LPO. Any NRP POC holder can now easily open. Additional 5 will be added as premium.

Financial Consumer Protection Framework. Slightly expensive as the coverage is added to the total borrowing amount. Yes InsuranceTakaful Accessories and VAT financing is available.

Avoids interest-based transactions riba and instead introduces the concept of buying something on the borrowers behalf and selling it back to the borrower at profit.

Difference Between Takaful And Conventional Insurance Pdf Takaful Versus Conventional Insurance Comparing The 2 Types Of Literature Based On Course Hero

Takaful Insurance Gulf Insurance Brokers Llc

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

Takaful Islamic Insurance Vs Conventional Insurance Youtube

Summary Of Differences Between Takaful And Conventional Insuareance Download Table

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

Comments

Post a Comment